Before you invest, you must have a clear understanding of why are you investing.

Investments must have a purpose and goals that are simple. It varies by individuals, but here are some examples.

Financial stress and anxiety affects most people. Things happen in life that causes you stress or anxiety. One way you can certainly manage your financial stress and take charge of your financial future is by taking charge of your investments and savings. It is always good to start early but it is never too late.

You are not alone. Many successful and highly qualified professionals can experience many challenges when it comes to savings and investments. That is why many wealthy individuals go from millionaires to personal bankruptcies. Regardless of your profession and interests, every person should have adequate understanding of personal finances and should at least understand the basics.

You need goals: if you don’t know where you’re going, you’ll end up someplace else

Yogi Berra

Execute your plan: vision without execution is hallucination

Steve Adams

You need a plan: a goal without a plan is a wish

Antoine de Saint-Exupèry

Whatever your goals are, once you have set your goals, you need to figure out a way to financially achieve those objectives and make it happen!

Savings is most important and investing is one way to supercharge your savings so you can achieve your financial goals. Investing is not brain surgery, but it does require clarity, quantification, focus, process and some discipline. It’s no different than any other task that is important to you.

Commit yourself: unless a commitment is made,

There are only promises and hope

Peter Drucker

Do your homework: by failing to prepare, you are preparing to fail

Benjamin Franklin

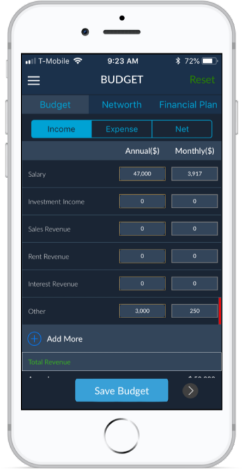

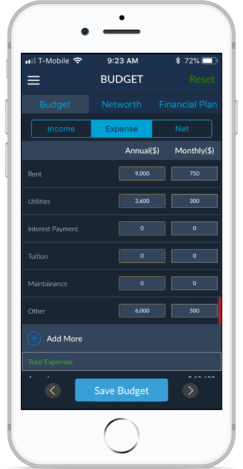

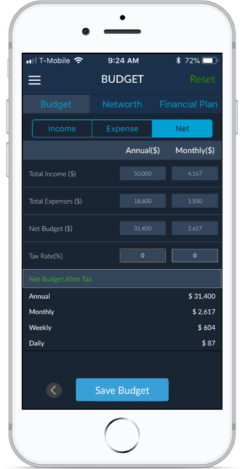

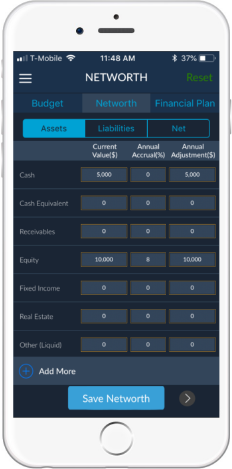

Zseniα’s My Finance (Budget and financial planning) tool is free for all and you can use the Finance application to evaluate your income and expenses with the objective of increasing your Net worth. Figure out how you can increase your income and reduce your expenses. It’s easier said than done, but it is certainly possible. It is also equally important to evaluate your assets and liabilities. Include all liabilities such as student loans and credit card balances. You can create an easy-to-use individual income statement, balance sheet, and a basic financial planning and savings plan to meet your financial goals in the future.

Zsenia’s Budget is free: Just input your assumptions & adjust it as you please to figure out a budget that is realistic.

Enter Your Income & Expenses

Evaluate Your Budget

Where there is a will there’s a way, so please do not give up since most things in life are not easy. Persistency will ultimately payoff. If you’re unhappy with your current income, now is probably the best time to look for a new career where new skills can translate into extra income. Your stress may mean it is time to change your career or job, or that you need to find ways to bring in more money. The second machine age has started which is disrupting almost every industry and in turn creates greater opportunity for new skills that you can certainly explore.

The bottom line is that you should be saving more than you are spending. In case you’re not saving enough, then make an honest effort and take small steps. Challenge yourself to earn and save at least an extra $100 per month or 3-5% of your monthly income. Everyone can earn more if they try.

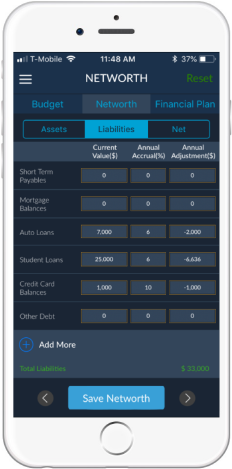

There is also nothing more stressful than debt hanging over your head. If you have debt, work hard to get rid of it or reduce to a level that you feel comfortable with. You are not alone and one of the biggest struggles for many, including millennials, is overcoming a negative net worth (your liabilities exceed assets). Eliminating that student loan debt is a key step for many. Leverage your additional income but also look at student loan repayment strategies to help lower that debt.

Enter Your Assets & Liabilities

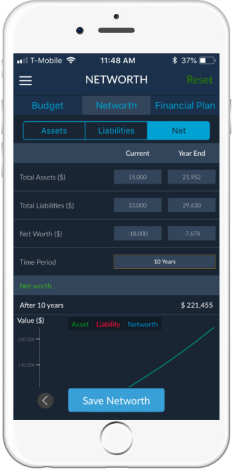

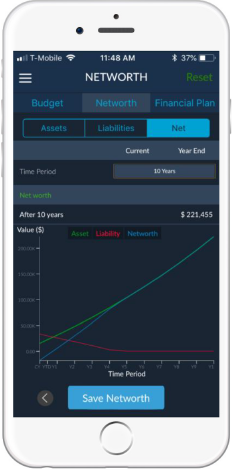

Evaluate Your Net Worth

If your financial situation is complex and time sensitive, it may be time to seek professional help. The great thing is that if you're young, you have a ton of time on your side to solve any financial challenge in the future. Time is the biggest ally you have in building wealth.

The Powerful Financial Planning option in Zseniα also provides you with investment alternatives that can address your future savings and capital building goals.

Stop and before you invest a dime, you must have a clear understanding of what is required (pre-requisites) to achieve your goals.

Here are the first things that you need to think about.

These can and are expected to change as you go through life but it is important to start any financial goal with these thoughts in mind.

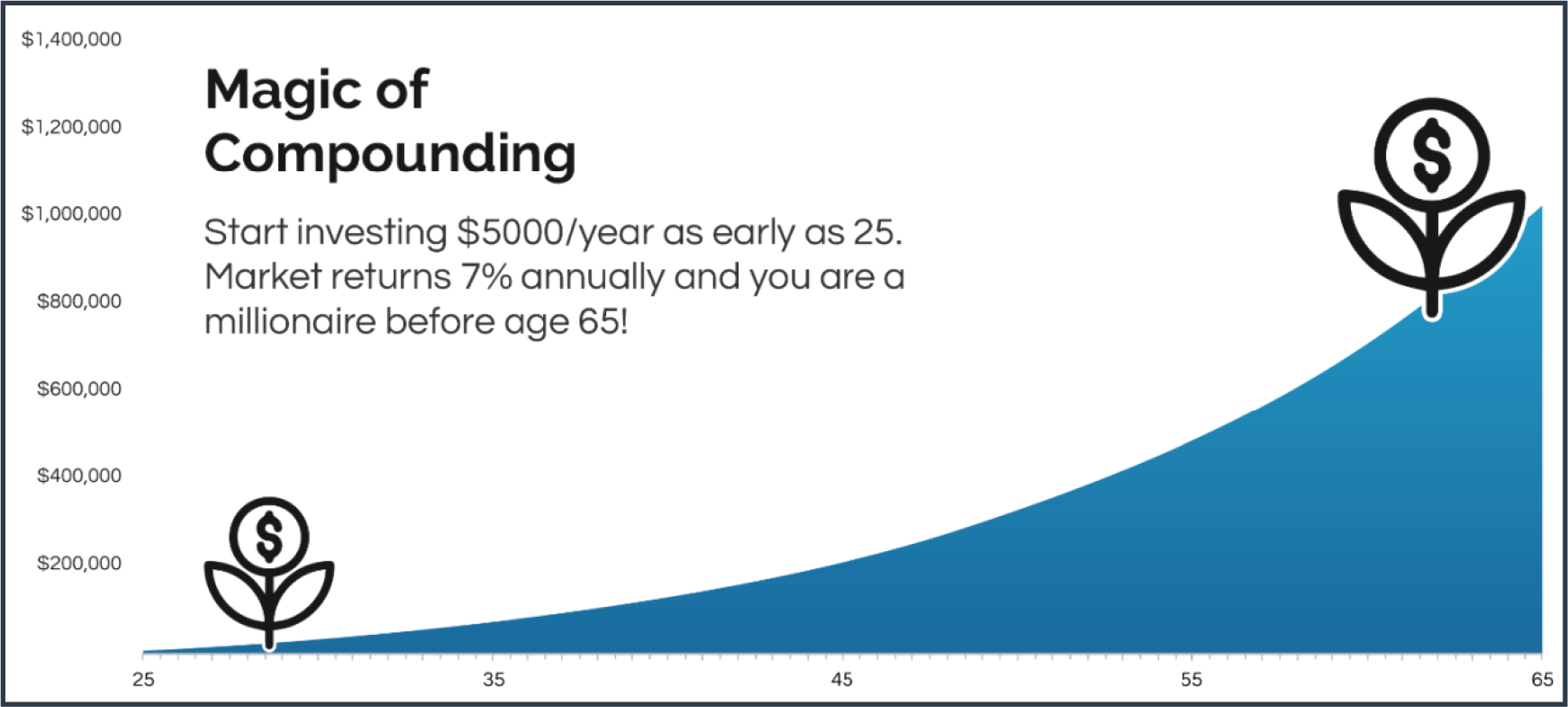

So, there are at least 3 ways to increase the amount you get out of investing. The money you invest upfront and on a monthly basis, the rate of return, and how long you expect to keep your money invested. You have somewhat direct control over 2 of the drivers, the money you put and the time you keep your money invested. Investing favors people with patience. The rate of return isn’t guaranteed. There are years where you will make money and there are years where you will lose money. That’s okay. In the long run, the economy trends upward. For instance the S&P 500 has an historical average return of 11.4% since 1928 including the down years.

Important things to keep in mind…

No Pain No Gain (Risk Versus Reward)

All investments have risks. There is no reason to panic but if you do not take any risk then you will not get any returns of substance. The key is to take calculated risks (that are measurable) and being rewarded for the risk you take. Risk is the price you pay for returns. A diverse portfolio should include some investments with high potential along with relatively safer investments. The younger you are, the more risk you should be willing to take. Someone in their early twenties has another four decades to make money, as opposed to someone in their late fifties, who is gearing up for retirement. Having a diverse portfolio means more than just picking stocks from different sectors. You have to be willing to balance those big companies with more high potential investments. That will depend a lot on your tolerance for risk and your age should play a big part in this.

Long Term View pays off big time

When investing, it is best to think of the long term. It is extremely easy to get caught up in the day-to-day fluctuations and news. But in the long run day-to-day fluctuations don’t really matter. The performance of the S&P during a few down months does not really matter since the S&P has risen significantly over time. There aren’t any 15-year periods where the overall market has declined. All of us should think long term when investing.

However, we must always ask if the down month is a short-term event and does it impact the fundamentals of the business? In most cases the short-term volatility has no impact on fundamentals but not always. The longer your investing timeline is, the less you have to worry.

When you invest, you should expect to not touch the money for 5 to 7 years. 9 months or 3 quarters is considered a short recession. The financial crisis of 2008 lasted over 18 months. It is important to be able to think long term as economies bounce back, and when they do, people who are invested gain the most. If you have any big expenses coming up in the next year or two, you should keep it in cash or short-term investments such as Certificates of Deposits (CDs) or Money Market accounts.

Again, if your financial situation is complex and time sensitive, it may be time to seek professional help but remember time is the biggest ally you have in building wealth.

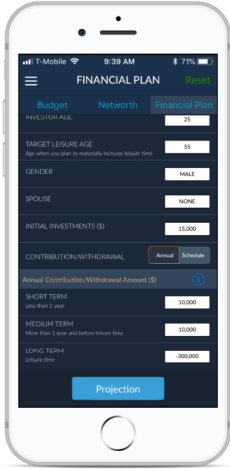

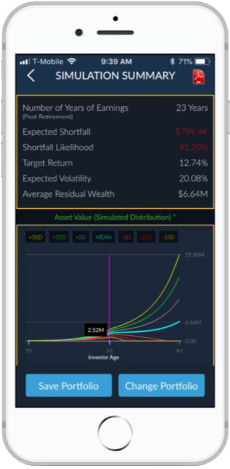

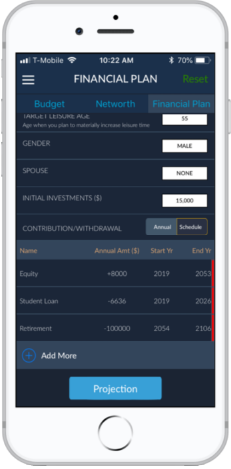

Zsenia’s My Finance tool allows you to see how feasible your financial goals are given your cash inflows and outflows. You can try out different scenarios to see which fits best for your life. Zsenia is a powerful yet simplified investment, research and analytics tool to educate and empower you regardless of your background. Growing your investments has never been easier. Zsenia helps you create an investment plan based on your budget (and risk tolerance), optimize your portfolio, and stay on track through changing market conditions. To get started with Zsenia’s Financial Planning Tool, you need to enter some basic info first. Enter your age, when you expect to stop working, your gender, and the age and gender of your spouse (if any), etc.

Enter your Contribution & Withdrawals, and run the Projection

Expected Shortfall must be Zero if not you need to adjust key assumptions

You can change your Target Leisure age, initial & Future Investments & Withdrawals

Once Expected Shortfall is zero, review your Target Return and Expected Volatility requirements, and Sample Passive Portfolio to explore investment alternatives

Then enter your initial and ongoing contribution information. First, include the amounts you can afford to invest now and within the next year. Then you want to input the amounts you will put in on a yearly basis until you plan to stop working (retiring). Finally input the amount you plan on living off of when you plan to stop working. Play around with the app. If your cash inflows are too low, you will get a shortfall and a likelihood of shortfall. In this scenario, you can either increase your inflows or decrease the amount you want to live off of. Bottom line do not give up, and remember every problem and challenge has a solution.

Also note that the more you want to live off of, the more return is required. The more return you need, the more risk you have to take. Return and Risk (volatility goes hand in hand). Figure out the level of risk you want to take.

As you can see in the above example, trying to live off $300,000 with only an initial contribution $15,000 and ongoing contributions of $10,000 is not feasible as you have a shortfall likelihood of 41.2%. That’s too high and too risky. Adjust it and then see what you get.

After adjusting it so that you only need to live off of 100,000 a year, the shortfall goes down to zero and the target return drops down to 9%. This situation is much more likely and less risky given the assumptions

Zsenia also gives you the option to use a schedule for your inflows and outflows. If you plan to buy a house, make a large purchase, expect an inheritance or have multiple inflows or outflows, this option is better for you. You can get as detailed as you want. Add any debt payments and how long you expect to pay them. This will give you a more accurate view of what your future will look like.

Keep playing around with your inputs and explore the possibilities. Zsenia gives you a passive ETF portfolio to at least start exploring and get started.

You MUST understand the following basic terms before you select a particular investment scheme or strategy.

Here is an important calculation that you need to know when investing your money.

Annualized Return = Your Money x (1+R) N

Your money is the amount you can invest

R is the expected rate of return

N is how long you expect you keep your money invested

Today you have many options for constructing a portfolio including Stocks, Bonds, Mutual funds and most importantly ETFs. However, before you construct a portfolio, you must know a few important facts.

First, the investment industry has been experiencing an unprecedented shift toward investing in passive investments, and since the launch of the first U.S. listed Exchange Traded Funds (ETFs) in 1993, this trend has only accelerated. Investors globally increasingly invest in ETFs for a variety of reasons, including as part of an overall investment strategy, for their lower cost structures, and the fact that most (not all) actively managed funds do not outperform the markets and indices over time.

ETF assets grew a whapping 3,000% in the past 15 years and now provide choices to fill the needs of investors from millennials to retirees. Over the last 10 years, ETF assets grew at least at an annualized rate of 24%, versus approximately 8% for Mutual Fund assets when compared to the same time period. There are currently more than 5,000 ETFs available for trading globally, and ETF assets are over $4.3 trillion and growing.

Second, it is very difficult (but not impossible) to consistently outperform the market (e.g. S&P 500 Index) for anyone. You may know already that roughly 1 in 20 actively managed domestic funds beat the index funds they track (according to Standard & Poor’s research). Over the last 15 years, 92.2% of large-cap funds lagged a simple S&P 500 index fund. The percentages of mid-cap and small-cap funds lagging their benchmarks were even higher: 95.4% and 93.2%, respectively. In other words, the odds you’ll do better than an index fund are close to 1 in 20 when picking an actively-managed domestic equity mutual fund.

Third, most experienced investment professionals know that there's no such thing as a strictly passive or active approach to investing. Rather, a thoughtful combination of active and passive strategies is required to consistently produce superior returns, over various market conditions.

Given all the above, most of us are probably better off investing in ETFs. ETFs are already replicating most investable assets globally, facilitating DIY investing – bypassing the needless intermediaries for the benefit of the investors. However, depending on your personal risk return expectations and investment sophistication, you can construct your own portfolio of stocks, bonds, mutual funds and ETFs. Below are brief descriptions of major instruments to consider.

Risk Assets or investments, include any assets that have a reasonable probability of depreciation as well as appreciation in value. These include Stocks, Bonds, Commodities, etc. Conversely Risk Free Assets or Investments include short dated government bond or certificate of deposit (CD) that are generally considered to be free from risk of monetary loss and may be used as a benchmark for evaluating investment performance.

As mentioned earlier, ETFs are already replicating most investable assets globally, facilitating DIY investing – bypassing the needless intermediaries for the benefit of the investors. Therefore, anything not covered above most likely can be invested through the ever-growing ETFs that anyone should consider.

In order to invest, you need to open a brokerage account. Today you have many options, even including Commission free trading offered by certain brokers (e.g. Robinhood) as well as many options for your 401k, which is a retirement account that is made available by ones employer.

In most cases the brokerage industry is fairly competitive, however commissions and fees could be different depending on the type of accounts and services you desire. In order to evaluate which brokerage account is suitable for you, you can compare commission per trade, monthly maintenance, access to online tools, minimum account size, etc. across multiple brokers and pick one that suits your need.

These accounts appeal most to those that are seeking an investment adviser. If you are to use an advisor, although doing so is both unnecessary and costly, it is better to seek one that is regulated as a registered investment advisor (RIA). If you utilize an advisor who isn’t regulated as such, you risk them giving you bad advice, so as to allow them to obtain kickbacks or commissions from investments that are unsatisfactory for you.

The 401(k) is a retirement account that is made available by ones employer. Typically, employees must elect to have a portion of their wages deducted directly from their paycheck (sometimes referred to as the direct contribution plan).

There are material benefits of 401(k) accounts and if available, one must take full advantage of such options provided by an employer. For 401(k) accounts, employers may automatically “match a portion of the contribution”, giving free money to the employee. For instance, if an employer matches up to 100% of the first 8% of employee income, and the employee and the employee invests $4800 in their 401(k), they will make gains of $4800 annually. Over a 20-year period of time, if this rate is maintained, the employee will have made $96000 in profit by the age of 50 without having done anything.

Employees can also deduct their contributions from income before calculating taxes. For instance, if the employee were to deposit $5000 in their 401(k) on a salary of $60,000, when the employees’ income tax would be calculated, it would be held against $55,000 as opposed to $60,000. Furthermore, this may place the employee in a lower tax bracket than if the tax included his initial income, perhaps allowing them to pay an even lower percentage. Employee investments that remain within the 401(k) account will be able grow completely tax-free so long as they remain there.

However, there are also a number of liabilities that are attached to the storage of income in a 401(k) account. 401(k) accounts do not allow you to withdraw from them until you turn 60. Hence, they do not allow short term spending goals to be achieved, as Employees will face severe tax penalties if they need to withdraw any money from their 401(k) before they turn 60. In this case, Employee’s will be taxed on retirement withdrawals from their account at an ordinary income rate. Also such withdrawals will likely be limited to a set approved amount by the employer.

The IRA is an account produced by the government for the objective of pressuring individuals to save for retirement separate from the 401(k), or other employer related systems. A traditional IRA has the same tax advantages as a 401(k), but it is entirely self-managed, so it lacks the constraints in investment selection compared to the 401(k).

The IRA has two Core Holdings weaknesses; for many people, contributions are only fully tax-deductible for those with an income below $56,000. The contribution limit on a traditional IRA is significantly lower than a 401(k), meaning there is only a limited annual amount of money that can be invested in it.

Ideally, an individual would have all 3 accounts (401k, IRA, Normal), which would allow them to reap the benefits of each particular one, and to use the diversification of the accounts to their advantage.

The government utilizes tax incentives as a means of encouraging citizens to save for retirement. Taxes play a key part in investments given what a large expense they can grow to become. In a similar manner, the earlier discussed fees can hinder ones’ ability to make profit on their investments. Taxes can also impede one’s ability to accumulate profit over time. Hence, should an individual take measures to keep portions of their money from being heavily taxed, they could make significantly more gains this way. Individuals can avoid paying certain taxes by placing their money directly into tax-sheltered retirement accounts.

Money not in a tax-sheltered retirement account is subject to 4 types of taxes:

The combination of all the taxes mentioned above can function as a sharp brake to the positive effects of compounding return. These taxes would reduce potential profits remarkably. That being said, it is very possible to save ones’ money legally from being charged taxes at such high rates. In order to do so, individuals must utilize the 401k and traditional IRA retirement accounts.